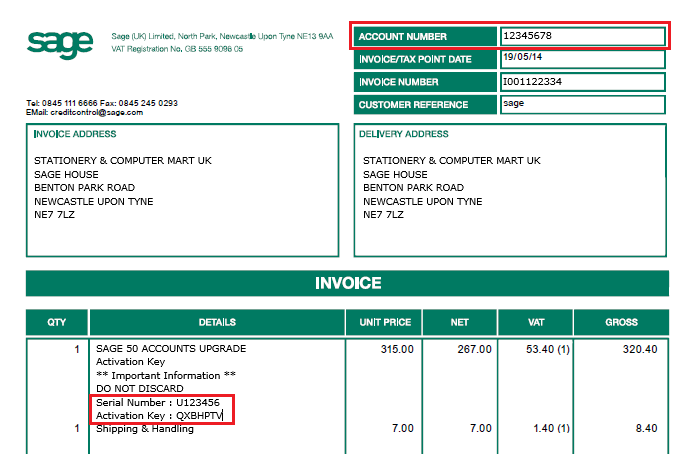

Serial Number And Activation Key For Sage Payroll Software

Where to find your serial number and activation key in Sage. Sage payroll serial number activation key In. Payroll V6 trail version to full software. A serial key, also recognized as a software key, is a specific software-based key for PC software. It certifies that the copy of the program is unique. Activation is now and then done offline by entering the key, or with online activation is requisite to prevent multiple people using the same key. Serials License Keys for.

• Valid credit card required to activate service. To ensure continuous service, your Sage Business Care plan is an automatically renewing plan, and subsequent years will be automatically billed to the same credit card each year on the anniversary date of your purchase at the then-current rate after notifying you 30 days in advance of your anniversary date. The credit card provided with this purchase will be used to automatically renew the plan if there is no other credit card number already established as your standard credit card number on file with Sage.

You may terminate the plan with at least seven calendar days’ notice prior to your renewal date and not be charged for the renewal. • Customer Support Analysts are available from 8:30 a.m. Until 8:30 p.m.

ET Monday-Friday, and reserve the right to limit a call to one hour or one incident. Assistance is limited to your Sage 50 solution. The following are new features included in Sage 50 Accounting 2016.2: Improved user experience Modernized user interface Sage 50 Accounting features a modern home window with a sleek and clean design.

The interface has been refreshed for a bright new look. When possible, font size has been increased for easier on-screen use and readability. Task flow icons have been updated to guide you in your work. Cloud and mobile pane in the home window With just a click, you can now access our integrated cloud and mobile offerings that are included with Sage 50c: Sage Drive and Sage One. If you need other services or simply want to explore, the Add-on Services tab has valuable information about the various services that integrate seamlessly with Sage 50 Accounting to improve efficiency. Get paid faster Store credit cards with Sage Vault 3 It's never been easier to get paid! You can readily sign up with Sage Payment Solutions from the home window.

Sage 50 Accounting is integrated with Sage Vault so you can now store multiple credit cards in the customer's record. With this secure technology, you can then select a stored card to use in a transaction and quickly process a payment. New interest option for late customer payments If you prefer to apply a one-time simple interest calculation to late customer payments, Sage 50 Accounting now features that option. Quicker search Support for multi-key search in lists When searching through a list of records, you can now benefit from multi-character filtering to pinpoint the record you're looking for.

When searching through a list of records, you can now benefit from multi-character filtering to pinpoint the record you're looking for. Improved search in inventory and service window If adding inventory items and services to an invoice, search has been enhanced to simplify your work.

Open the Select Inventory/Service window and start typing. It's that easy. Payroll compliance 4 T4A form for vendors and contractors: If you need to produce T4A slips for vendors and contractors, the Vendor Records now features a T4A & T5018 tab for easy access to filing options. The Report menu now features a T4A option and the Vendors list report has new optional fields. Record of Employment on the Web updated: As technology evolves, Sage stays ahead of the game with you and your business in mind. In step with changes from the CRA, the exported file format for ROE Web has been updated to Version 2.0.

On April 1, 2016, all employers must use an electronic file with Version 2.0 specifications. Reporting in box 235 on RL-1: Sage 50 Accounting now reports your employee's contribution (or premium) paid to a private health services plan. Payroll tax updates for January 1, 2016: If you have a payroll plan, you benefit from timely and comprehensive in-house payroll processing within Sage 50 Accounting to help you save time and reduce the risk of payroll tax penalties at year-end. The following are new features included in Sage 50 Accounting 2016.0: Improved updating and installation experience Sage Drive Enhancements Easily access your shared data and manage access with confidence. • Manage access to your data through the Sage Drive Management Centre. If you need to remove access to your data, you can delete a user from Sage Drive.

• Easily sign in to Sage Drive with another ID when opening a different Sage 50 Accounting company file. Sage One Integration Enhancements Setting up Sage One to work with your Sage 50 Accounting company is even easier. You can now make updates to the Sage One categories directly from the Connection Setup Wizard inside Sage 50 Accounting. • View Sage One categories and their matching Sage 50 accounts for an improved workflow. • Quickly rename or renumber Sage One categories during connection setup.

• Remove Sage One categories that you do not need. • Add and update products or services Sage View connects to Sage 50 Accounting data Accountants and bookkeepers: Designed especially for accounting professionals, the new cloud-based Sage View31 allows accountants and bookkeepers to connect to their clients’ Sage 50 data in order to provide real-time analyses, alerts, and reports based on Key Performance Indicators (KPIs) that are specific to each client. This in turn empowers accounting professionals to provide more strategic advisory services to their clients, leading to greater successes for their clients. Sage 50 Accounting customers: By letting your accounting professional connect your Sage 50 data to Sage View, your accountant or bookkeeper can deliver insights on your financial health that you can use to make solid decisions faster that lead to more success for your business. The following are new features included in Sage 50 Accounting 2015.3: Improved updating and installation experience Sage Drive - Access your Sage 50 Accounting file in the cloud with Sage Drive • For a faster and easier sign in, Sage 50 Accounting remembers the email address you use. • If you have shared your company, you can pause sharing and keep working, even without an Internet connection. Resume sharing without having to re-invite other users.

Keep Sage 50 Accounting up to date while you’re on the move with Sage One Integration - Mobile app for your phone By downloading the Sage One Mobile app (iOS and Android), you can now do everyday tasks on the go and synch your data with Sage 50 Accounting. • Create, email and update invoices • Record purchases and expenses • Add and update your business contacts • Add and update products or services Improved Integration with Sage One - Faster setup and easier day-to-day use With improved integration to Sage One you can automatically map your Sage 50 Accounting customer records, vendors, accounts, inventory items and tax codes to Sage One for a quick, easy setup and perfect record match every time. You’ll now find that recording transactions in Sage One gives you the benefits of anytime, everywhere bookkeeping and the integration into Sage 50 Accounting allows you to maintain your robust, desktop accounting processes. Bank Feeds - Import bank transactions with just a few clicks Reduce the amount of data entry you do by importing transactions from your bank accounts, credit cards and PayPal accounts. With bank feeds you’ll no longer need to download electronic statements from your bank and manually import them. Bank feeds are set up in Sage One. Improved communication with customers and vendors - Transaction source number included in direct deposit email and attachment If you are using direct deposit for payments to vendors and from customers, the email they receive now contains the transaction source number in the email subject line and attachment.

This allows for efficient tracking of payments. The following are new features included in Sage 50 Accounting 2015.2: Sage Drive - Save time by saying goodbye to USBs and transfer systems • Access your data from anywhere you have Sage 50 Accounting installed and have Internet access. • Share your data with your accountant or bookkeeper.

No more transferring of data, copying files back and forth, or using Accountant's Copy files. Sage One Enhancements Enhancements for future functionality with Sage One and the integration between Sage One and Sage 50 Accounting were made. Enhanced inventory serial number reporting When creating a serial number report, you can now opt to show only inventory items with an Available status. T5018 Summary and language of correspondence When generating a T5018 Summary, the language of correspondence now appears. The following are new features included in Sage 50 Accounting 2015.1: Improved sales process and administration Support for employer contributions in VRSP (Quebec only) If your employees participate in the Voluntary Retirement Savings Plan (VRSP), employers can now easily contribute to their plans when running payroll.

Employer expenses defined by amount or percentage Employers with user-defined expenses have the flexibility to choose to set those expenses by a specific amount or a percentage. Mobile invoicing* Create and send invoices online from anywhere at anytime and have it all integrated within Sage 50 Accounting. You or your employees no longer need to wait to get back to the office to create an invoice.

You can now create an invoice on the move using Sage One and your data will sync back to Sage 50. Available February 2015. *Additional fees may apply. Improved workflow when Connection Manager needs to be updated on a server If you connect to your data on a server which does not have the most recent update of Sage 50 Accounting, you will now see a message about updating the Connection Manager. The following are new features included in Sage 50 Accounting 2015.0: Improved customer statements for easier collections Keep track of who owes you money by generating statements for customers with outstanding or overdue balances.

Statements show amounts outstanding or overdue in addition to any payments made. Support for compound interest for overdue sales invoices Create an incentive for customers to pay you on time by charging a daily interest rate on overdue invoices. More information included on orders, invoices, and packing slips Provide more details to your customers by adding more information fields to their orders, invoices, and packing slips. If you sell products or services with that require a more detailed description or additional information, you can include that for your customer's benefit. Better workflow when modifying a sales template in Sage 50 Forms Designer When you customize a template and choose to save, the Save as dialog automatically opens so you can name your file and save your work. More efficient processing of customer receipts and vendor payments If you are processing multiple payments from a customer or to a vendor, you can reuse the selected customer or vendor by clicking the pushpin. Payroll Integration with Manulife PRPP and VRSP (Quebec only) This easy-to-use integrated solution will help Quebec employers comply with mandatory government regulations quickly and easily.

The Voluntary Retirement Savings Plan (VRSP) Act came into effect on July 1, 2014 whereby all small businesses with five or more employees will be required to offer a workplace savings plan. The integrated payroll solution offers a streamlined payroll workflow through Sage 50 Accounting—Canadian Edition while simplifying the ongoing administration of Manulife’s new VRSP. This saves time and reduces redundant data entry: • Prefill VRSP contribution file for each payroll cycle • Prepopulate employee information files created by Sage 50 Accounting to ensure accurate information is sent to Manulife to administer employees' records. Option to not calculate income tax If you have employees whose total income is less than their total claim amount on their TD1, you can turn off tax calculation in their employee record. Credit card payments with Moneris Faster credit approval process with payment processing by Moneris Sage has partnered with Moneris, Canada’s leading payment processor, to deliver cost-effective and efficient credit card processing services through Sage Payment Solutions. Powerful reporting now available in Sage 50 Pro Accounting Custom accounting reporting with Sage 50 Intelligence Reporting Get customizable Microsoft® Excel® - based business accounting reports, automatically updated with realtime data, so you can access the information you need to make swift, confident decisions. Discontinuations Linux is no longer supported as a file server for sharing company files.

(Red Hat Enterprise Linux 5.0n and SUSE Linux Enterprise Server 10 were previously supported). The following are new features included in Sage 50 Accounting 2014: Efficient updates and installation If you're updating from the Sage 50 Accounting 2013.3 release, you get to experience product updates that are quick, convenient, and effortless. We've eliminated work interruptions by making the updates download in the background. We've also simplified installation even further by not requiring you to enter your key code or serial number if you're connected to the internet.

Minimized file size for faster downloads and installation Your time is valuable for your business. We've given you back some more by making product downloads and installation much faster with a smaller file size. Sales Taxes - Keep Up With Government Changes Changes to the Manitoba sales tax Effective July 1, 2013, the Manitoba Retail Sales Tax (RST) rate increased to 8%.

This tax is calculated on the selling price of most goods and some services, before the GST is applied. New companies created in this release use the new rate of 8%. For further information about this change, go to. Increased stability Database upgrade Your business is always moving forward and so should your software.

We're preparing for tomorrow by upgrading the Sage 50 Accounting database to MySQL 5.6.10. This new technology provides you with increased stability and gives you peace of mind as your business grows. Technology to help you get the most out of your Sage 50 Accounting investment Sage Advisor New technology has been added to Sage 50 Accounting that will help you discover valuable capabilities so you can become more efficient and effective while using Sage 50 Accounting.

You'll get information where and when you need it. The following are new features included in Sage 50 Accounting 2013: Sage 50 First Step Accounting Installation – Easier to Install or Upgrade Install Sage 50 in 5 clicks Installing Sage 50 is easier with an improved wizard. In 5 easy steps, you’re guided through a more streamlined process that provides clearer installation options and more intuitive instructions. Electronic Payments – Increased Convenience Email vendors a payment notification for electronic payments Avoid any payment discrepancies by notifying your vendor whenever you make a direct deposit to their bank account. You have the option to email a direct deposit stub to your vendor after you record an electronic payment in Sage 50.

Free Download Ik Multimedia Amplitube 3 Full Version. Sales Taxes – Keep Up With Government Changes Update QST in Quebec The QST Update wizard helps Quebec customers convert easily by updating their QST tax and tax codes to the new rate and new basis of calculation. Return to PST in British Columbia The BC PST Update wizard helps B.C. Clients convert easily by creating a new PST tax and new tax codes that include GST and PST. Change to HST in PEI The HST Update Wizard helps PEI clients convert easily to the new HST by creating new tax codes. Sage 50 Pro Accounting Sage 50 Pro Accounting has all the benefits of Sage 50 First Step Accounting plus the following features: Installation – Easier to Install or Upgrade Install Sage 50 in 5 clicks Installing Sage 50 is easier with an improved wizard. In 5 easy steps, you’re guided through a more streamlined process that provides clearer installation options and more intuitive instructions. Employees – Remain Accurate Track insurable vacation hours required on Record of Employment (ROE) slips Employers are required to record the employee's work history on a Record of Employment (ROE) form, including the employee's insurable vacation hours.

To comply with this requirement, Sage 50 Accounting 2013 records and tracks the number of total insurable vacation hours taken for you, and enters them directly in box 15A on the ROE form that you create in Sage 50. Sales Taxes – Keep Up With Government Changes Update QST in Quebec The QST Update wizard helps Quebec customers convert easily by updating their QST tax and tax codes to the new rate and new basis of calculation. Return to PST in British Columbia The BC PST Update wizard helps B.C. Clients convert easily by creating a new PST tax and new tax codes that include GST and PST. Change to HST in PEI The HST Update Wizard helps PEI clients convert easily to the new HST by creating new tax codes. Sage 50 Premium Accounting, Sage 50 Quantum Accounting, and Sage 50 Accountant Edition Sage 50 Premium Accounting, Sage 50 Quantum Accounting, and Sage 50 Accountant Edition have all the benefits of Sage 50 Pro Accounting plus the following features: Installation – Easier to Install or Upgrade Install Sage 50 in 5 clicks Installing Sage 50 is easier with an improved wizard.

In 5 easy steps, you’re guided through a more streamlined process that provides clearer installation options and more intuitive instructions. Electronic Payments – Increased Convenience Accept and record credit card payments in US dollar currency with a US dollar merchant account If you do business in US dollars and have customers who prefer to be billed in US dollars, you can now record, process, and track credit card payments in US dollars in Sage 50. In this way, Sage 50 not only allows you to accommodate your customer needs, these transactions are also recorded more accurately when they are in a single currency. Integrated with Sage Payment Solutions 1, you can also switch between multiple Sage Payment Solutions accounts and choose to process foreign credit card payments in a Canadian dollar or US dollar merchant account. Business Insight – Get Easier Access To Key Data Customize financial spreadsheets using the new Report Designer This version of the Sage 50 Business Intelligence 2 includes the Report Designer, a Microsoft® Excel® add-in that expands the existing functionality of the Report Manager.

The Report Designer allows the novice user to generate financial reports more easily and decreases the need for manual cut-and-paste. In addition, Sage 50 Business Intelligence provides a user-friendly way to create or modify the layouts of these reports to suit your reporting needs. Receive timely business reports on the go Get your business intelligence reports when you need it, even when you're away from your desk. With Sage 50 Business Intelligence, you can easily share reports by email, FTP, or web publishing, and also set up rules so that you only receive reports when you want to. View graphical trend forecasts of key business data (available only in Sage 50 Quantum Accounting) The Trends Forecast dashboard illustrates your company's projected performance in a set of four graphs, and provides trend forecasts of your business' key performance data or indicators (KPIs).

Based on your company's historical data, the Trends Forecast dashboard maps out the trends it finds in your company's data. The dashboard is easily accessible in the program and allows you to adjust your plans quickly to changes in your business. Employees – Remain Accurate and Compliant Look up and review posted paycheques When you need to verify the information on a posted paycheque or if you need to make a correction, you can look up and display the paycheque quickly using the Look Up tool. In the payroll journal, you can look up and make corrections to paycheques made in the current and previous year.

You can also bring up individual paycheques by drilling down in the payroll reports. Track insurable vacation hours required on Record of Employment (ROE) slips Employers are required to record the employee's work history on a Record of Employment (ROE) form, including the employee's insurable vacation hours.

To comply with this requirement, Sage 50 Accounting 2013 records and tracks the number of total insurable vacation hours taken for you, and enters them directly in box 15A on the ROE form that you create in Sage 50. Post paycheques into future years This new feature makes it convenient for employers to record a post-dated paycheque in a new year, and make your records more accurately reflect your business process. Instead of making multiple manual entries, you can now record paycheques in the Payroll journal and date them in the next calendar year without closing off the current fiscal year.

You can also look up these paycheques to make corrections at any time. Sales Taxes – Keep Up With Government Changes Update QST in Quebec The QST Update wizard helps Quebec customers convert easily by updating their QST tax and tax codes to the new rate and new basis of calculation. Return to PST in British Columbia The BC PST Update wizard helps B.C.

Clients convert easily by creating a new PST tax and new tax codes that include GST and PST. Change to HST in PEI The HST Update Wizard helps PEI clients convert easily to the new HST by creating new tax codes. • Subject to approval and to Sage Payment Solutions terms and conditions. Additional fees, including swipe terminal for card present transactions, internet access, and credit card required. • Requires Sage 50 Business Intelligence. Additional fees apply. Streamlined Installation Wizard Simply Accounting has simplified the installation wizard by reducing the number of steps in the installation process.

The wizard also provides more guidance to help you through the installation process, including notes about how to install the software on systems that use a firewall. Improved Sales and Purchases Windows The re-designed Sales and Purchases windows are more user-friendly, and allow you to enter information more quickly and efficiently. New Simply Accounting Troubleshooting Tool The new Simply Accounting Troubleshooter helps you understand and recover from common Connection Manager issues. To access the Simply Accounting Troubleshooter, on your desktop, open the Start menu and select Simply Accounting Troubleshooter from the Simply Accounting program group.

Note: The Simply Accounting Troubleshooter is not available on Linux. Faster Start-Up Times The time it takes to open company files in Simply Accounting is now shorter. Easier Access to Balances and Totals From the Latest Transaction Date By default, total sums and balances on the Home Window are now calculated using the latest transaction date. You can still display balances by session date if you select Calculate Record Balances in Home Window Lists by Session Date as a user preference.

Preparing ROE Forms for Web Submission ( Payroll Only) You can now create a bulk ROE file in Simply Accounting which allows you to prepare more than one ROE form and submit them to the ROE Web site in a single draft file. You can review, modify, and print these ROE forms before they are submitted to the Canada Revenue Agency.

For those who are not familiar with how to complete the ROE forms, Simply Accounting provides the appropriate help with each field in the form. Faster Start-Up Times The time it takes to open company files in Simply Accounting is now shorter. Additional Enhancements in Simply Accounting Enterprise Improved Inventory Management The following changes were made to improve how inventory is managed in Simply Accounting Enterprise: • Simplified removal of inventory items Remove items from your inventory without clearing the tracking data for all items. This means you can still look up past transactions that use these removed items. Inventory items with a zero quantity and value can now be deleted in one easy step. • Control who removes inventory Simply Accounting has added new inventory user permissions to safeguard your data when using the new inventory removing feature.

• Faster reporting Simply Accounting Enterprise has improved the speed at which inventory reports are generated. With the increased reporting speed, you can generate reports as often as you wish without having to wait for a long time. Faster Transaction Posting in Multi-User Mode To speed up data entry, transactions go through a verification process. If any errors or conflicts are detected, you will be notified and then allowed to fix the issue in the Unprocessed Transactions window before re-posting the transaction. More Platforms to Store Your Company Data You can now store and access your Simply Accounting data from a supported Linux Server.

The Connection Manager for Linux is available free-of-charge to all customers running Simply Accounting 2009. The Simply Accounting Connection Manager is supported on the following platforms: • Windows 2000 • Windows XP • Windows Vista • Windows Server 2003 R2 and 2008, and Windows Small Business Server 2003 • Linux SuSE Enterprise Server 10 • Linux Red Hat Enterprise Server 5 Additional Report Enhancements • Auto-fit Column Size: All reports include a full set of customization features, including the ability to change a column's width to fit all contents. • We have also improved the Tax Report to make it easier to transcribe the results to the GST/HST Remittance form. Additional Banking Features The Transfer Funds feature now supports credit card receivables and payables, in addition to cash and bank accounts. You can now quickly record a transfer of funds to or from your credit card, bank, or line of credit accounts. E-mail Simply Forms in PDF Format Your custom Simply Forms, such as customer invoices, can now be e-mailed as PDF attachments.

Automated Credit Card Processing Automate your credit card processing with an affordable online service from Sage Payment Solutions. When you sign up for a merchant account at Sage Payment Solutions, you can authorize credit card payments directly from Simply Accounting sales transactions, and then go online to manage your account and view payment reports. More Learning Resources and Enhanced Help Search • Redesigned Learning Centre: Use the redesigned Learning Centre as your launch pad for all Simply Accounting learning resources. You'll find new and frequently updated information in the Learning Centre, including training information and videos, answers to frequently asked questions, updated news and service offerings, and have real time access to discussions in the Simply Accounting Online Community. • Enhanced Help Search: Search for answers to your questions in the Help, or search the Online Community directly from Simply Accounting. • New Getting Started Page: Follow the links and directions in the Getting Started page to learn what to do after you've created your company database, and get help with common tasks. Automatic Activation If you are connected to the Internet, you can now retrieve your Simply Accounting activation key code directly from us, online, instead of manually typing in the information from your registration e-mail.

And, if you're eligible for payroll services, your Simply Accounting payroll id will be automatically retrieved and entered to give you immediate access to automatic payroll calculations. Sage Simply Accounting Pro Streamlined Setup and Conversion Options • Use the new Setup Guide to quickly add or edit customer, vendor, employee, and account information. Be sure to watch the quick start tutorials to see just how easy it is to set up your business records in Simply Accounting. • The New Company Setup Wizard now directly supports quick and easy conversion of your QuickBooks® 2006 or 2007 company to Simply Accounting. Additional Home Window Enhancements • The Home Window now displays all window contents, without scrolling, at an 800 x 600 display resolution. If you're still using the Classic View, switch to the Enhanced View and give the new Home Window another try. • List panes are now customizable.

You can show or hide columns that are not the primary name or description. • All changes you make to the Home Window are now saved - including list pane customizations, and whether a pane is expanded or collapsed. Additional Report Enhancements • Project Reports: You can now Show Corrections on Project reports.

• Account Reconciliation Reports: We've simplified the formatting of all Account Reconciliation reports, and you can now customize the report columns in the Summary and Detail reports. • Deposit Slip Detail Report: We've improved multicurrency reporting in the Deposit Slip Detail report.

E-mail Direct Deposit Stubs If you direct deposit an employee's pay, you can now e-mail a copy of the direct deposit stub (in PDF format) to the e-mail address noted in the employee record. Several e-mail form templates are provided, which you can customize, if required, in the Simply Form Designer. Payroll Enhancements • Order of EI and CPP Amounts: We've switched the order that EI and CPP fields display on payroll screens and key reports to help you avoid transcription errors when completing government forms such as the PD7A remittance form. • Withhold Additional Quebec Tax: You can now deduct additional Quebec income tax from a Quebec employee's pay. To automatically withhold additional Quebec tax from an employee's pay, fill in the Additional Quebec Tax field on the Taxes tab of the employee's record. • Gross (Taxable) Payroll Amount on the Remittance Summary Report: To help you complete the PD7A payroll remittance form (which records CPP, EI, and Federal Income tax payable to the Receiver General), the gross (taxable) payroll amount for all employees in the remittance period is now noted on the Remittance Summary report.

• Additional Columns in the Employee Detail Report: You can now customize the Employee Detail report to include the system-defined Federal and Quebec benefit amounts (defined as Benefits and Benef. Que in Settings >Payroll >Incomes), and the payroll period end date. • New Year End Review (PIER) Report for payroll subscribers: Active payroll subscribers can display and print the new Year End Review (PIER) report. This report will identify CPP/QPP and EI discrepancies so that you can review and revise your payroll records before you product employee T4 slips. This report is based on the Canada Revenue Agency's Pensionable and Insurable Earnings Review (PIER). Sage Simply Accounting Premium Additional Report Enhancements • New Sales Receipts by Payment Method Report: The summary of receipts by payment method has been removed from the Sales Synopsis report and is now included in the new analysis report, Sales Receipts by Payment Method.

• Hide Account Detail in Financial Reports: You can now hide 'group' and 'subgroup' accounts on the Income Statement and Balance Sheet, including comparative versions of these reports. Customize the report using the new Totals option in the Modify Report window, or conveniently expand or collapse the accounts in select groups or subgroups directly in the displayed report. Sage Simply Accounting Enterprise More Scalable For complex operations and growing businesses, Simply Accounting now supports up to: • 1000 Departments • 1000 Price Lists • 100 'Ship To' Addresses per customer More Granular Security In Simply Accounting Enterprise, there are now more ways to secure your company information. You can now limit a user's access to Account Reconciliation and Deposit Slips in the Accounts & General Ledger module.

In the new Advanced Reporting window, you can also control exactly which Financial and Banking reports a user can view and edit, giving users access rights to only the reports they need. New Database More robust, greater security, and faster for users with high volume of transactions and/or records. Report Enhancements • Save reports in PDF format • Customization of reports - Dynamic sorting, moving, resizing of columns directly in the report. • Refresh on demand - To minimize the time delay caused by having all open reports refresh every time a new transaction is posted. • Print Preview & Select pages to print - Saves paper and time.

• Export to Excel with formatting intact - Saves time (no need to duplicate formatting effort). • CTRL+F find feature - Saves time; quickly locate any term or value in the report. • Increased Performance - Ability to generate, scroll, etc at much faster rate. • Report Layout changes - Embellish reports to a standardized format.

Visual feedback when completing transactions To re-assure new users that the transaction didn't just disappear. Also, displays journal entry number that's been assigned in the confirmation window.

Show invoice subtotal amount in the sales window In addition to showing up on the printed form, it will now appear on screen. Show PAID on invoice when invoice has been paid Show invoice date in payments and receipts Sage Simply Accounting Pro Home Screen Redesign Simply Accounting now has a new look - Easy to use interface designed to replicate your workflow. Report Enhancements • Save reports in PDF format • Customization of reports - Dynamic sorting, moving, resizing of columns directly in the report. • Refresh on demand - To minimize the time delay caused by having all open reports refresh every time a new transaction is posted.

• Print Preview & Select pages to print - Saves paper and time. • Export to Excel with formatting intact - Saves time (no need to duplicate formatting effort). • CTRL+F find feature - Saves time; quickly locate any term or value in the report. • Increased Performance - Ability to generate, scroll, etc at much faster rate. • Report Layout changes - Embellish reports to a standardized format. New Database More robust, greater security, and faster for users with high volume of transactions and/or records.

Ability to work in 2 fiscal years at a time Enabling the 'automatic reversal/correction' feature for transactions dated in the previous fiscal period makes year-end adjustments much easier. Full 7 years of historical data Keep detailed information as required by CRA audit standards.

Transfer Money Journal Easily transfer money between accounts with the new transfer funds journal available in the banking module. Also supports multicurrency transactions.

Visual feedback when completing transactions To re-assure new users that the transaction didn't just disappear. Also, displays journal entry number that's been assigned in the confirmation window. Show invoice subtotal amount in the sales window In addition to showing up on the printed form, it will now appear on screen. Show PAID on invoice when invoice has been paid Show invoice date in payments and receipts Sage Simply Accounting Premium Home Screen Redesign Simply Accounting now has a new look - Easy to use interface designed to replicate your workflow. Report Enhancements • Save reports in PDF format • Customization of reports - Dynamic sorting, moving, resizing of columns directly in the report. • Refresh on demand - To minimize the time delay caused by having all open reports refresh every time a new transaction is posted. • Print Preview & Select pages to print - Saves paper and time.

• Export to Excel with formatting intact - Saves time (no need to duplicate formatting effort). • CTRL+F find feature - Saves time; quickly locate any term or value in the report.

• Increased Performance - Ability to generate, scroll, etc at much faster rate. • Report Layout changes - Embellish reports to a standardized format. New Database More robust, greater security, and faster for users with high volume of transactions and/or records. Ability to work in 2 fiscal years at a time Enabling the 'automatic reversal/correction' feature for transactions dated in the previous fiscal period makes year-end adjustments much easier. Store project details for multiple years Transfer Money Journal Easily transfer money between accounts with the new transfer funds journal available in the banking module.

Also supports multicurrency transactions. Visual feedback when completing transactions To re-assure new users that the transaction didn't just disappear. Also, displays journal entry number that's been assigned in the confirmation window. Show invoice subtotal amount in the sales window In addition to showing up on the printed form, it will now appear on screen. Show PAID on invoice when invoice has been paid Show invoice date in payments and receipts Sage Simply Accounting Enterprise Home Screen Redesign Simply Accounting now has a new look - Easy to use interface designed to replicate your workflow. Report Enhancements • Save reports in PDF format • Customization of reports - Dynamic sorting, moving, resizing of columns directly in the report. • Refresh on demand - To minimize the time delay caused by having all open reports refresh every time a new transaction is posted.

• Print Preview & Select pages to print - Saves paper and time. • Export to Excel with formatting intact - Saves time (no need to duplicate formatting effort). • CTRL+F find feature - Saves time; quickly locate any term or value in the report. • Increased Performance - Ability to generate, scroll, etc at much faster rate. • Report Layout changes - Embellish reports to a standardized format.

New Database More robust, greater security, and faster for users with high volume of transactions and/or records. Ability to work in 2 fiscal years at a time Enabling the 'automatic reversal/correction' feature for transactions dated in the previous fiscal period makes year-end adjustments much easier. Role-based security settings You can control which users have access to which areas of your accounting system.

With enhanced security, you can confidently manage a multi-user environment. Serialized inventory You can easily track items as they move through inventory, so they can more efficiently manage their operations and improve customer service. Store project details for multiple years Transfer Money Journal Easily transfer money between accounts with the new transfer funds journal available in the banking module. Also supports multicurrency transactions. Visual feedback when completing transactions To re-assure new users that the transaction didn't just disappear.

Also, displays journal entry number that's been assigned in the confirmation window. Show invoice subtotal amount in the sales window In addition to showing up on the printed form, it will now appear on screen. Show PAID on invoice when invoice has been paid Show invoice date in payments and receipts. • Add a 'clear' button to Batch Printing • Allow user to customize transaction window • Calculate vacation pay on released Vacation • Combine all Settings into One • Conversion and Backup Improvement • Easier to set options for reports • Extend Field Lengths • Home window improvements • Identify mandatory fields in all ledgers.

• New user interface (2nd layer) • Prepaid orders • New Gross Margin Income statement • Lookup and adjustments in payments and receipts • Enhanced search capabilities - in LIW and enter lists. • Online Banking (OFX) • Checklists • Ability to budget projects • Import Sales Orders, Pur. Invoices, and Pur. If you're upgrading from Sage Simply Accounting Pro 2007 or earlier versions, you will either need to select Sage 50 Premium Accounting or Sage 50 Quantum Accounting. Sage 50 Premium Accounting and Sage 50 Quantum Accounting are the only products that support multiple users. Sage 50 Premium Accounting supports up to 4 user licenses and Sage 50 Quantum Accounting supports up to 40 user licenses in increments of 5. If you have multiple users, you should consider upgrading to either Sage 50 Premium Accounting or Sage 50 Quantum Accounting products.

The past 'Basic' product is now positioned as Sage 50 Pro Accounting because it provides all the tools you need to accelerate the growth of your business. Sage 50 First Step Accounting is our single-user entry level accounting software package for entrepreneurs, small or home-based business owners who require a simplified accounting software package. If you are currently using pen and paper method or a spreadsheet program, this is a great place to start. This product doesn't have payroll or inventory management functionality. It provides easy to use tools to track revenues, expenses, and tax.

Recommended System Configuration • 2.4 GHz processor for single user and multiple users • 1 GB of RAM for single user and 2 GB for multiple users Minimum System Requirements • 2.0 GHz processor for single user and multiple users • 1 GB of RAM for single user and multiple users • Windows ® XP SP3, Windows Vista ® SP1, Windows ® 7, or Windows ® 8, with the latest updates from Microsoft installed • 1 GB of disk space for installation. • Internet Explorer 7.0 required; Internet Explorer 8.0 and 9.0 supported • Microsoft ®.NET Framework CLR 4.0.

Serials License Keys for registration Serial key for: Adobe Acrobat (all versions) 1118-1266-5014-2191-0731-1231, 1118-1496-8147-4470-9398-4720 1118-1266-5014-2191-0731-1231, 1118-1496-8147-4470-9398-4720 Extended serial Number od Adobe Acrobat 6.0 Professional V.